This week's mini-series app of the week is Nutmeg. Nutmeg is a UK based investment platform that offers an ESG investing (Environmental, social and corporate governance). They're unique for a variety of reasons but one thing that stood out to us was that they use an independent body MSCI ESG Research LLC to accredit their ESG scores. We also have a special referral code which means you can get your first six months of investment fee-free (see below).

What is it?

According to their website Nutmeg are now the largest digital wealth manager in the UK, sounds fancy doesn't it? Nutmeg was founded in 2011 by Nick Hungerford and William Todd. Their aim is simple they want to make investing accessible to everyone. They give complete transparency to their customers about fees and avoid complex pricing structures or jargon.

Their setup is easy (more on this later), first, you create an account with them. Second, you set up a pot of money. Thirdly you choose your investment style and risk and then finally you pay in. They will then manage the funds for you and do all the hard work.

Nutmeg offers a range of products, Pensions, Lifetime ISA's, Junior ISA's, Stocks and Shares ISA's and general investment ISA's. All of which put you in control of the amount of risk you're willing to take with your money. Additionally, something that sets them apart is that they allow you to chose an ESG investing option for any product.

Why is Nutmeg our app of the week?

Having used nutmeg for over two years now we've been really impressed by them. They have navigated (And continue to navigate through) some very complex financial times. The pandemic hit business hard. Despite that Nutmeg has been forthright with their decisions, kept us calm and carried on and (so far) kept us in profit. At the time of writing, my folio is 26.33% up on an ESG investment portfolio. Remember past success is not a guarantee of future gains. Which is great comfort in these tremulous times.

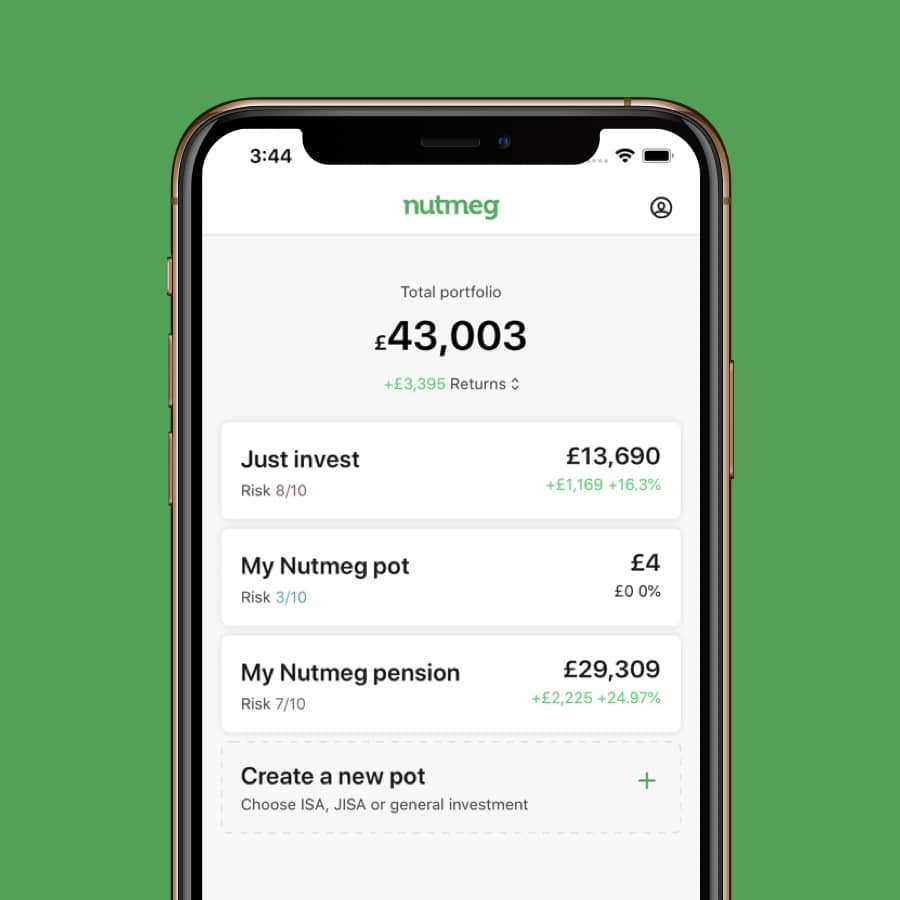

When it comes to their app, its simple (in a good way), considered, well balanced, well laid out and performant. Once you have an account with them the home screen displays all of the products you have open and their performance. There is a separate page that displays your ISA allowances for the current year (which is very useful to track against). A pay in page (for obvious reasons) a help section and a news section.

This news section provides some really insightful and regular updates on what they're up-to and what will affect your investments.

They provide news and updates typically on a weekly basis. And cover a range of topics all of which are related to their fund management.

Another small win for their app is that it supports Dark mode (so no more eye strain).

In addition, they also recently launched a new feature that allows you to see the exact trades that they make. It's great to have that level of transparency around their practice and further reinforces their clear expertise.

The same level of transparency also applies to the ESG investment info from MSCI Research LLC. Which is beautifully visualised for easy comparison to equivalent non-socially responsible portfolios.

How do I use nutmeg for ESG investing?

The first thing to do is to do some research. Have a look at your options form other providers like wealthsimple and remember to speak to a financial advisor if you're unsure. Remember no-one at Coolcuration is qualified to give financial advice, as such all of this post should be viewed as for information purposes only. You have to make investment decisions by yourself and should seek appropriately qualified experts before making decisions.

Once you've done that and you're feeling ready to invest with Nutmeg create an account with them. If you use our referral link you will get your first 6 months of investing fee-free.

Once you have an account tap the "create a new pot" option to start the process. The first choice you have to make is as to the type of account. If you haven't put any money into a stocks and shares ISA this year that's likely a good choice. If however, you have paid money into a S&S ISA then the General investment account is probably what you want.

Step two is giving it a name and setting a goal.

The third step is setting your timeline (longer is usually better as it means you'll ride out more ups and downs). Nutmeg has a really helpful tool under the "need help deciding link" if you come unstuck.

Step 4 is setting up your contributions. At this point, it's worth considering cost weight averaging as a great way to avoid big ups and downs affecting your investments too much is to spread them out. So, rather than going all-in at day one consider splitting that large sum into monthly payments over a longer timeframe.

The fifth step is choosing your investment style. As the focus of this post is ESG investing we're going to select the "Socially responsible" option. But you should read through all of the options and decide which one is right for you.

Step six is selecting a risk profile. This is really important and you should consider it deeply. As a rule of thumb, more risk means the potential for more loss as well as more gains. It's definitely worth speaking to the team at nutmeg if you're at all unsure at this point. Equally anyone who is qualified to give financial advice would be a wonderful person to contact.

After this they'll display to you the historical performance of the investment type which should give you a simulation of how well you may or may not do.

After that it's as simple as reviewing and confirming.

At this point your best bet historically is to leave them to it. Nutmeg will actively manage the funds and do their best to ensure you end up in profit.

Remember if you decide that Nutmeg is for you you can use our referral link you will get your first 6 months of investing fee-free.

This content is intended for informational purposes only and does not constitute financial advice or an endorsement of Nutmeg’s services. CoolCuration is not affiliated with Nutmeg and is not authorized by the FCA to provide investment recommendations. ESG (Environmental, Social, and Governance) investing involves specific risks and may not be suitable for all investors. You should conduct your own research or consult a qualified financial advisor before making investment decisions.

Thanks for reading

That's all for this post. If you have any suggestions for things we should cover or topics for the blog please leave them in the comments. Thanks again for reading, if you enjoyed this post please consider sharing it with your friends and remember to check out our gift guides.

No Comments.